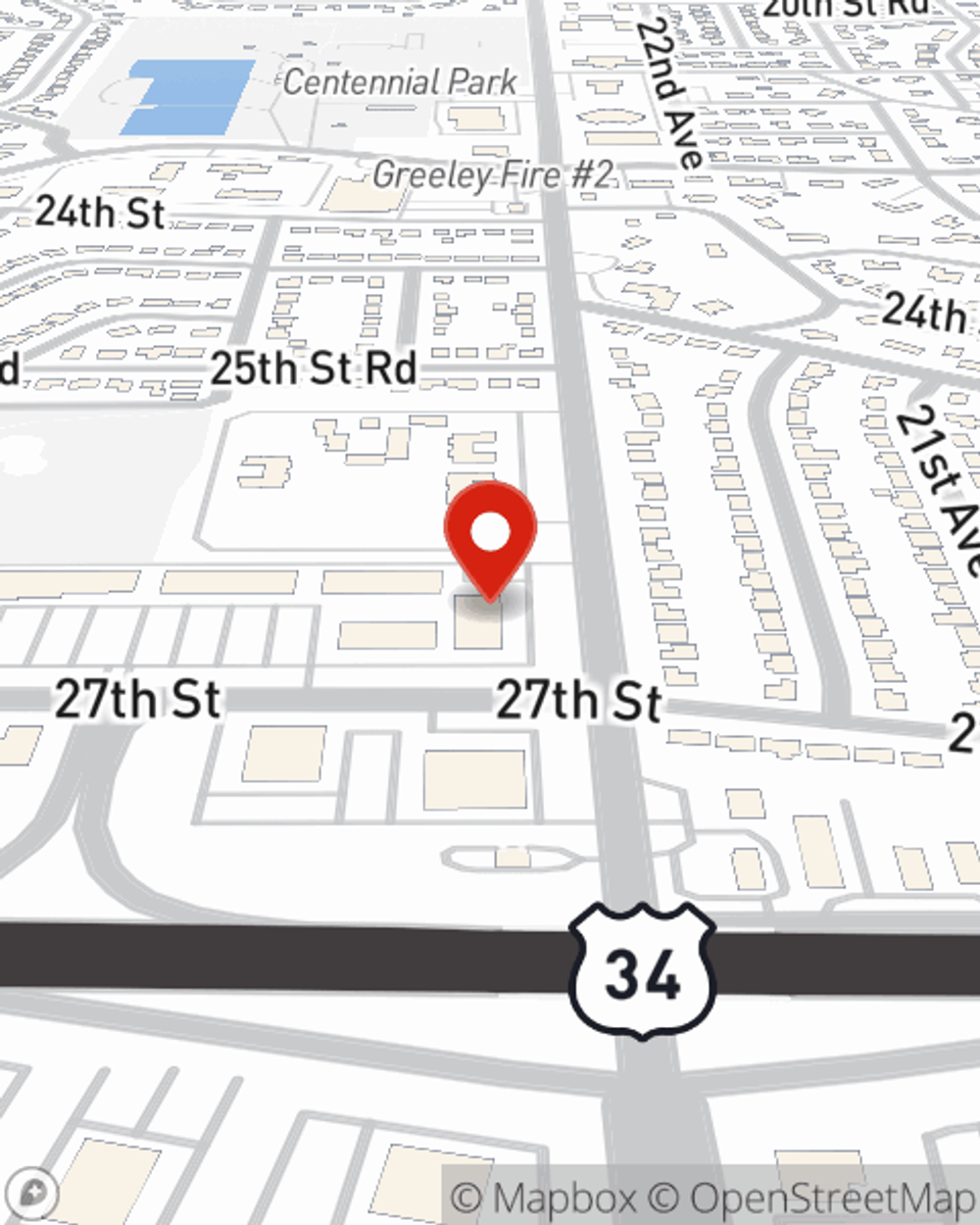

Life Insurance in and around Greeley

Get insured for what matters to you

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

When facing the loss of your spouse or a family member, grief can be overwhelming. Regular day-to-day life halts as you prepare for arrange for burial funeral services, and face life without the one you love.

Get insured for what matters to you

Now is the right time to think about life insurance

Greeley Chooses Life Insurance From State Farm

Choosing the right life insurance coverage is made easier when you work with State Farm Agent Jesse Herrera. Jesse Herrera is the caring associate you need to consider all your life insurance needs. So if you pass, the beneficiary you designate in your policy will help the people you're closest to or your loved ones with certain expenses such as grocery bills, rent payments and future savings. And you can rest easy knowing that Jesse Herrera can help you submit your claim so the death benefit is paid quickly and properly.

With reliable, compassionate service, State Farm agent Jesse Herrera can help you make sure you and your loved ones have coverage if something bad does happen. Visit Jesse Herrera's office now to get started on the options that are right for you.

Have More Questions About Life Insurance?

Call Jesse at (970) 373-3233 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Jesse Herrera

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.